Cereals

Market situation in 2017

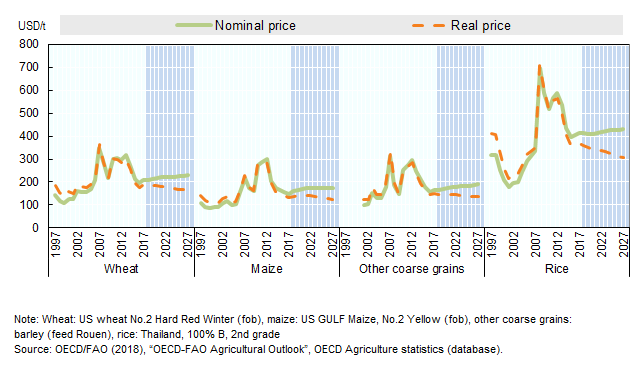

Global supplies of major cereals have exceeded overall demand in recent years, leading to a significant build-up of inventories and much lower prices in international markets as compared to the previous decade. World production of cereals reached a new high in 2017, exceeding the previous peak in 2016. Maize output increased the most, reaching a record in 2017, driven largely by higher production in several major exporting countries. Wheat output was high but slightly below the record set in 2016, and other coarse grain output declined in 2017 due mainly to lower barley production in Australia and lower sorghum and barley production in the United States. Rice output overtook the previous year’s record due to continued growth in Asia and a recovery in Latin American production. Given years in which growing cereals production has outpaced demand growth, leading to ample supplies and stocks, international nominal prices in the near term are expected to rise only moderately with support from stable demand and rising oilseed prices. However, in real terms prices will decline over the next ten years.

World Cereal Prices

Projection highlights (2018-2027)

Prices for cereals, except for maize, reversed the downward trend that started a few years earlier and climbed modestly in 2017. Maize prices, however, fell in 2017 pressured by high stocks. The low prices for all cereals registered during the base period (2015-2017) are likely to give way to higher prices in the near term supported by higher oilseed prices although the gain is expected to be limited because of continued large stocks and slower growth in food and feed demand compared to the previous decade. In the medium term, however, cereal prices are projected to increase in nominal terms, but to decline slightly in real terms.

Global cereal production is projected to expand by 13% between the base period and 2027, mainly owing to higher yields. Production of wheat is projected to increase from 750 Mt in the base period to 833 Mt in 2027, with most of the growth in India (20 Mt), followed by the European Union (12 Mt), the Russian Federation (10 Mt), Pakistan (6 Mt) and Turkey (5 Mt). Maize production is expected to rise by 161 Mt to 1.2 bln t, led by the People’s Republic of China (31 Mt), Brazil (24 Mt) and the United States (22 Mt). Production of other coarse grains is projected to increase by 29 Mt to 327 Mt by 2027, with the largest increases in Ethiopia (5 Mt) and the European Union (4 Mt). Rice production is projected to increase by 64 Mt to 562 Mt, with 84% of this increase in Asian countries, led by India (20 Mt), Indonesia (8 Mt) Thailand (7 Mt) and Viet Nam (4 Mt). Producers in the Least Developed Countries (LDC) Asian region, which include Bangladesh, Myanmar and Cambodia, will increase rice production by 7 Mt by 2027.

Global cereal use is projected to increase by 14% between the base period and 2027, mainly owing to higher food and feed use in developing countries. Wheat consumption is expected to increase by 13% compared to the base period, and continues to be largely used for human consumption, with food use accounting for about two-thirds of total use throughout the projection period. The use of wheat for animal feed is projected to increase, mostly in China, the Russian Federation and the EU28, while use of wheat for biofuels is projected to account for only 2% of global use in 2027.

» The full chapter is available here.

Related Documents