Fish and seafood

Market situation in 2017

The global fishery and aquaculture sector expanded further in 2017, with a faster growth rate than 2016. This increase was primarily accounted for by a recovery in catches of anchoveta (mainly used to produce fishmeal and fish oil) in South America and by a further expansion of aquaculture production, which continues to rise at some 4% a year. As in more recent years, aquaculture was responsible for the major growth of overall production and consumption.

Despite the higher level of production in 2017, additional demand generated by improving economic conditions globally lifted fish prices. The FAO Fish Price Index highlights higher prices in 2017 compared with 2016, in particular in the first nine months of 2017, followed by a slight decline towards the end of the year. This increase in prices, together with higher traded volumes, has made 2017 the year in which the value of total trade of fish and fishery products reached its peak. Despite higher prices, consumption was strong due to sustained consumer demand for fish, supported by the improving economic environment in both developed and developing regions, including recoveries of some major emerging markets such as Brazil and the Russian Federation.

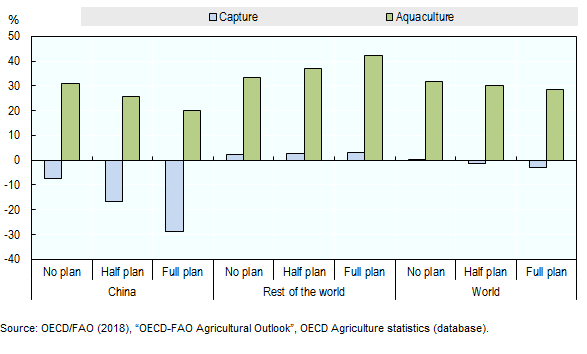

The potential impact of the Chinese plan on growth in world aquaculture and capture production

Projection highlights (2018-2027)

This year's Outlook contains major changes relative to the preceding years concerning fish production in the People’s Republic of China (hereafter “China”) for both capture and aquaculture. The first change is that China’s 13th five-year plan (2016-2020) aims to, among other things, improve efficiency and sustainability in its fisheries sector, but this also implies potentially substantial reductions in growth for its aquaculture industry and reduced capture fisheries landings. Given China’s significance in fisheries at the world level, even accounting for only the most likely outcomes of these objectives in this year’s baseline has resulted in total production in China being much lower in this outlook, which has had a visible impact on the projections for world fish production and consequently prices, trade and consumption. The second change is that estimates of the value of aquaculture production in China have been substantially upwardly revised since the last outlook, in light of new information, a change that has also affected aquaculture prices at the world average level.

Fish prices will all increase in nominal terms over the duration of the outlook period. The average nominal world price for traded fish will increase by a total of 23.7%, demonstrating a relatively sustained growth trajectory that takes it from USD 2 828/t in the base period to USD 3 499/t in 2027. The weighted average price of aquaculture species is expected to have a lower rate of growth when compared to what was observed in the preceding decade (+1.5% p.a. vs +4.4% p.a.) as it is now starting from a high level, but its rate of growth will still be higher than that for capture species. The aquaculture price is now expected to increase by a total of 19.5% over the period, from USD 2 878/t to USD 3 439/t. Growth in the average nominal price of wild caught fish should remain steady as capture fisheries have limited ability to influence the quantities or compositions of the species they land at the global level. Average nominal capture fishery prices are consequently expected to go from USD 1 557/t to USD 1 819/t over the projection, an increase of 16.8%.

The quantity of fish produced at the world level is also expected to continue growing, increasing every year other than when the second of two assumed El Niño events is imposed in 2026. Overall growth is expected to be relatively low, with total production increasing by 13.4% between the base period and 2027, around half the increase seen in the previous decade (27.1%). The annual average rate of growth reflects this slowdown, being only slightly above 1% p.a. World growth will be completely founded upon the continued but slowing growth in aquaculture output. Capture fisheries production is expected to fall slightly over the outlook, period and result in 1.05 Mt less fish being caught in 2027 than in the base period (growth rate of -0.01% p.a.), mainly due to a reduction in catches by China. This decline should be partly compensated by expected growth in other areas also thanks to stricter management measures, which should allow the recovery of certain stocks.

A greater share of fish production will go to human food consumption by 2027 (91%) than in the base period (89%). However, mirroring the slowdown in fish production growth, global food fish consumption is anticipated to increase by just 1.2% p.a., a substantial decline when compared to the 3.0 p.a. growth rate witnessed over the previous decade. Overall food fish will increase from 153 Mt in the 2015-17 base level to 177 Mt in 2027. About 72% of this total will be consumed by Asian countries, which will account for 73% of the total increase in food fish consumption. In per capita terms, apparent fish food consumption is projected to rise slightly, from 20.3 kg in the base period to 21.3 kg in 2027, with the annual growth rate declining from 1.8 to 0.3%. Per capita fish consumption will increase in all continents, except Africa (–4% as population growth outpaces growth in supply), with Latin America and Asia showing the highest growth rate.

Fish and fish products for human consumption and non-food products will continue to be highly traded with about 38% of total fishery production (31% excluding intra-EU trade) expected to be exported in 2027. World trade of fish for human consumption is projected to expand by 18% or 7 Mt live-weight equivalent (lw) by 2027. However, its annual growth rate for exports will decline from the 1.9% p.a. observed in the previous decade to 1.6% p.a. over the coming decade partly owing to increasing prices, and the slowdown in production. Asian countries will continue to be the main exporters of fish for human consumption, slightly increasing their share in world exports from 49% in the base period to 50% in 2027.

In addition to the possible consequences of the potential changes to be implemented in the fisheries and aquaculture sector in China, a number of uncertainties and challenges exist that influence the evolution and dynamics of the world fisheries and aquaculture sector. For production, these include issues related to the natural productivity of fish stocks and ecosystems, environmental degradation and habitat destruction, overfishing, illegal, unreported and unregulated fishing (IUU), climate change, weather patterns, transboundary issues with respect to natural resource utilisation, poor governance, invasion of non-native species, diseases and escapes, accessibility and availability of sites and water resources, as well as to technology and finance. Furthermore, trade policies, trade agreements and market access remain important factors influencing the overall dynamics of the fish markets. From the perspective of market access, issues include those related to food safety and traceability, the need to demonstrate that products are not derived from illegal and proscribed fishing operations.

» The full chapter is available here.

Related Documents