Oilseeds and oilseed products

Market situation in 2017

Global soybean production declined slightly in the 2017 marketing year (October 2017 to September 2018), as the harvest in South America (in the first months of 2018) fell short of the year before. Soybean production in the People’s Republic of China (hereafter “China”) and also in Canada increased considerably, due to the increased attractiveness of soybeans compared to other crops. India, by contrast, saw a decline in production. The aggregate world production of other oilseeds (rapeseed, sunflower seed and groundnuts) in 2017 remained almost unchanged.

The growing demand for protein meals, especially in China, has been the main driver behind the expansion of global oilseed production. However, growth in soybean imports by China has been only moderate in the marketing year 2017, in part due to the destocking of maize.

Vegetable oil production continued to increase in 2017 compared to 2016, although the growth was smaller than in previous years, due to a slow recovery in palm oil production after the 2015 El Niño. Increasing import demand around the world became evident and led to the refilling of stocks, including in importing countries. Per capita food use of vegetable oils also continued to grow both in developed and developing countries, though at a much faster rate for developing countries.

Overall the oilseeds and products markets were stable during the marketing years 2016 and 2017 with no major disruptions.

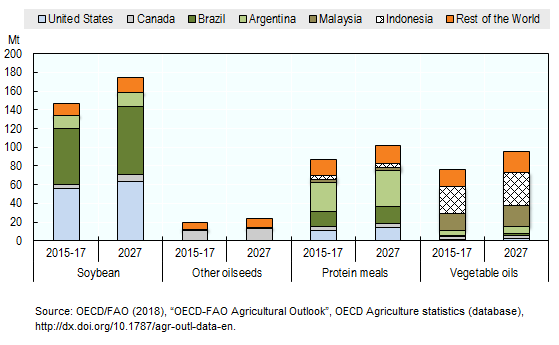

Exports of oilseeds and oilseed products by region

Projection highlights (2018-2027)

In nominal terms, all oilseeds and oilseed product prices are projected to increase slightly over the outlook period. Due to saturated per capita food demand, stagnation in the biodiesel sector and ongoing livestock intensification in many emerging economies, vegetable oil prices will decline at a faster rate than protein meal prices in real terms over the outlook period. Prices for soybeans and other oilseeds are also projected to decline in real terms. Nevertheless, volatility should be expected due to market uncertainties.

During the outlook period, global soybean production is expected to continue to expand, but at 1.5% p.a., which is well below the growth rate of 4.8% p.a. of the last decade. This slowdown is due mainly to a slower area expansion. Brazil and the United States are expected to compete throughout the projection period for the place as largest producer, with production reaching 129 Mt and 131 Mt respectively by 2027. Production of other oilseeds increases by 1.6% p.a. over the next decade, below the 3.1% p.a. growth rate of the previous one. Crushing of soybeans and other oilseeds into meal (cake) and oil continue to dominate usage and will increase faster than other uses, in particular direct food consumption of soybeans, groundnuts and sunflower seeds as well as direct feeding of soybeans. Overall, 90% of world soybean production and 86% of world production of other oilseeds are projected to be crushed in 2027.

Vegetable oil includes oil obtained from the crushing of soybeans and other oilseeds (about 55% of world vegetable oil production), palm oil (35%), as well as palm kernel, coconut and cottonseed oils. Despite a slowdown in the expansion of the mature oil palm area, significant production growth is projected in Indonesia (1.8% p.a. vs. 6.9% p.a. in the previous decade) and Malaysia (1.4% p.a. vs. 1.3% p.a.). Growth in demand for vegetable oil is expected to be slower in the coming decade due to (i) reduced growth in per capita food use in developing countries (1.2% p.a. compared to 3.2% p.a. in the previous decade) as consumption levels are approaching saturation levels, and (ii) the projected stagnation in demand for vegetable oils that are used to produce biodiesel.

Protein meal production and consumption is dominated by soybean meal. Compared to the past decade, consumption growth of protein meal (1.6% p.a. vs. 4.2% p.a.) will be limited by slower growth in global livestock production and by the fact that the protein meal share in Chinese feed rations has reached a plateau. Chinese consumption of protein meal is projected to grow by 1.7% p.a. compared to 7.2% p.a. in the previous decade, a rate which still exceeds the growth rate of animal production.

Vegetable oil has one of the highest trade shares (41%) of production of all agricultural commodities. This share is expected to remain stable throughout the outlook period, with global vegetable oil exports reaching 96 Mt by 2027. Vegetable oil exports will continue to be dominated by Indonesia and Malaysia (Figure 4.1), which are strongly export-orientated: nearly 70% of Indonesian and more than 80% of Malaysian vegetable oil production is exported. In both countries the share of exports is expected to slightly decline as more vegetable oil will be used as feedstock for biofuels and vegetable oil consumption for food use will gain importance. Indonesian exports will grow at 1.6% p.a. compared to 5.8% p.a. in the last decade.

» The full chapter is available here.

Related Documents