Fish and Seafood

Market situation

During 2015, the global fishery and aquaculture sector showed sustained growth in overall production and consumption. In 2014, aquaculture’s contribution to total fish supplied for food overtook that of wild fish for the first time and this trend continued in 2015. In the same year, after a period of continuous expansion, trade of fish and fishery products declined in value terms. This slowdown was caused by economic contractions in key markets, exchange rate developments and lower fish prices. China, the leading producer, processor and exporter, and the third largest importer of fish and fishery products entered a period of serious uncertainty, even reducing its fish exports due to a slowdown in its processing sector. Seafood consumption in the Russian Federation suffered from the effects of its continuing trade embargo on fish from certain countries. Norway had record total export values, while in Thailand and other large shrimp supplying countries lower shrimp prices pushed total export values down significantly. Catches of anchoveta (mainly used to produce fishmeal and fish oil) were better than expected, relieving some short-term pressure on fishmeal and fish oil prices.

Prices of wild species increased more than those of farmed seafood in 2015, as measured by the FAO Fish Price Index (base 2002-04 = 100). Since reaching a peak in March 2014, with the index at 164, overall fish prices have shown a decreasing trend, with the index falling to 135 in July 2015 due to reduced consumer demand in key markets and an increased supply in certain fishery species. During the end of 2015 and early 2016, prices started to slightly recover.

Projection highlights

The outlook for the fish sector remains largely positive. In nominal terms, average fish prices are all expected to decline in the first part of the projection period before recovering in the last five years of the outlook period. In 2025, average producer prices are projected to be slightly higher than during the 2013 15 base period, as demand growth is expected to outpace supply. However, the average prices for traded products for human consumption, fishmeal and fish oil are projected to be slightly lower in 2025 relative to the base period. In real terms, however, all prices are expected to decrease over the next decade from the record highs attained in 2014.

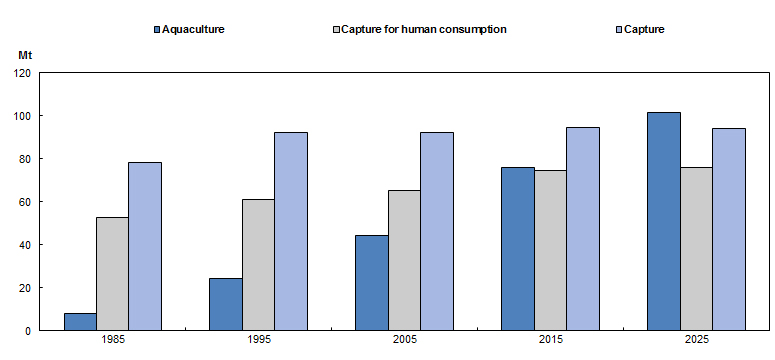

World fish production is projected to grow at 1.5% p.a. during the outlook period, a slowdown relative to the 2.5% p.a. of the previous decade. Production is expected to reach 196 Mt, with an overall increase of 29 Mt, or 17%, between the base period and 2025. Most of the production growth for fish will take place in developing countries and in particular in Asia. As capture fisheries production is expected to increase by only 1%, by 2025, the majority of growth will come from aquaculture, which will surpass total capture fisheries in 2021 (Figure 3.6). Despite the increasing role of aquaculture in total fish supply, the capture sector is expected to remain dominant for a number of species and vital for domestic and international food security.

Aquaculture will continue to be one of the fastest growing food sectors despite its average annual growth rate slowing from 5.4% p.a. in the previous decade to 3.0% p.a. in the period 2016-25. This deceleration is due to higher costs, combined with competition for land, water and labour from alternative production systems. Much of the increase is expected in freshwater species.

Figure 3.6. Aquaculture production and capture fisheries

Note: “Capture for human consumption refers” to the Capture production excluding ornamental fish, fish destined to the production of fishmeal, fish oil and other non-food uses. All aquaculture production is assumed to be destined to human consumption.

Source: OECD/FAO (2016), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-data-en.

World production of fishmeal is expected to increase by 15% in 2025 relative to the average 2013-15 level to reach 5.1 Mt, while fish oil should grow by 17% to 1 Mt during the same period. Approximately 38% of fishmeal in 2025 will be obtained from fish by-products.

World fish consumption as food is projected to increase by 21% (or 31 Mt live weight (lw)) in 2025 compared to the base period, growing at 1.8% p.a. in the next decade compared to 3.1% p.a. in the previous one. In 2025, fish originating from aquaculture is expected to represent 57% of the fish consumed. Fish consumption will continue to expand more strongly in developing countries than developed countries, where there is an overall slowdown in consumption growth. Per capita fish consumption is expected to increase in all continents, while the fastest growth rates are projected for Oceania and Asia.

Fish and fishery products (fish for human consumption, fishmeal) will continue to be highly traded with about 36% of total fishery production (31% excluding intra-EU trade) expected to be exported in 2025. Trade of fish for human consumption is projected to increase by 18% (or 7 Mt lw) by 2025. However, its annual rate of growth is projected to decline from 2.3% p.a. during the last decade to 1.9% p.a. over the next decade reflecting the slowdown in production and demand. Developing countries will continue to be the main exporters of fish for human consumption, but their share in world exports will decrease from 67% in 2013-15 to 66% in 2025. During the same period, developed countries will reduce their share in world imports from 54% to 53%.

A number of uncertainties and challenges can affect projections for fish. The outlook for capture fisheries, fishmeal and fish oil depend on the natural productivity of fish stocks and ecosystems, which is uncertain, as well as on variable weather patterns. For aquaculture, relevant factors are the accessibility and availability of sites and water resources as well as to technology and finance; the sustainability, availability and cost of fish seeds (e.g. eggs, spawn, offspring, fry, larvae) and feeds; antibiotic use; assessment of environmental impacts (including pollution, fish diseases and escapees); and food safety and traceability issues. Furthermore, trade policies, trade agreements and market access remain important factors influencing the overall dynamics of world fish markets.

» Access the fish and seafood chapter and all graphs on the OECD iLibrary