Oilseeds and Oilseed Products

Market situation

Global soybean production for the 2015 marketing year (see glossary for a definition of marketing year) continued to increase, whereas production of other oilseeds (rapeseed, sunflower seed and groundnuts) declined relative to 2014. Low crude oil and cereal prices put additional pressure on oilseed prices.

Vegetable oil production increased more slowly than oilseed production for two reasons. First, palm oil yields decreased in Southeast Asia due to El Niño and, second, the slow production growth of oilseed oils due to an increased share of soybeans (containing less oil than other oilseeds) in the oilseeds market. However, growth in vegetable oil demand has slowed recently due to contracting biodiesel production from vegetable oils in 2015 in several developed and developing countries. Vegetable oil prices are expected to recover first within the oilseed complex due to currently stagnating production.

The continuously growing demand for protein meals has been the main driver behind the expansion of oilseed production in recent years. This has increased the share of protein meals in the returns from the crushing of oilseeds, and more so for soybeans over other oilseeds due to its higher protein content. Compared with coarse grains and other feed ingredients, protein meal prices have declined recently to historically average levels, meaning that protein meal prices are about 1.5 to 2 times those of maize.

Projection highlights

In nominal terms all oilseeds and oilseed product prices are projected to increase over the outlook period. The price relationships within the sector will shift slightly in favour of the meal component. Due to saturation in per capita food demand in many emerging economies and reduced growth in biodiesel production from vegetable oils, vegetable oil prices will decline whereas protein meal prices will increase slightly in real terms during the outlook period.

During the outlook period, global soybean production is expected to continue its expansion, yet at 2.4%, below the annual growth rate of 4.2% experienced during the last decade. Production of other oilseeds increases by 1.2% p.a. over the next decade, considerably below the growth rate of 3.6% p.a. in the previous decade. Globally, crushing soybean and other oilseeds into meal (cake) and oil dominates total usage and it increases slightly faster than other uses, notably direct food consumption of soybeans, groundnuts and sunflower seed. Overall, 91% of world soybean production and 84% of world production of other oilseeds will be crushed in 2025.

Vegetable oil includes oil from the crushing of soybeans and other oilseeds (around 55% of production), palm (36%), as well as palm kernel, coconut and cottonseed oils. World vegetable oil production will remain concentrated among a few countries in the coming decade. Despite a slowdown in area expansion, significant production growth still occurs in the main palm oil producing countries: Indonesia (2.5% p.a. vs. 8.1% p.a. in the previous decade) and Malaysia (2.1% p.a. vs. 2.4% p.a.). The other source of growth is soybean oil produced from the increased production and crushing of soybeans. Demand growth for vegetable oil is expected to slow down in the coming decade due to: a) reduced growth in per capita food use in developing countries, at 1.5% p.a. compared to 3.0% in the previous decade; and b) only slight increases in biodiesel production from vegetable oils at 1.5% p.a., due to the gradual fulfilment of biodiesel mandates.

Protein meal production and consumption is dominated by soybean meal. Compared to the past decade, consumption growth of protein meal slows down (2.2% p.a. vs. 3.9% p.a.), reflecting both slower growth in global livestock production and saturated levels of protein meal in Chinese feed rations. Chinese consumption of protein meal is projected to grow by 2.7% p.a. compared to 7.9% p.a. in the previous decade, still exceeding the growth rate of animal production however.

Growth in the world trade of soybeans is expected to slow down considerably in the next decade, compared to the previous decade. This development is directly linked to the projected slower growth in soybean crushing in the People’s Republic of China (hereafter “China”). Because the growth in livestock production is expected to be concentrated in the main protein meal producing countries, domestic use of protein meal increases while trade will only expand slightly in the coming decade, resulting in a declining share of trade in world production.

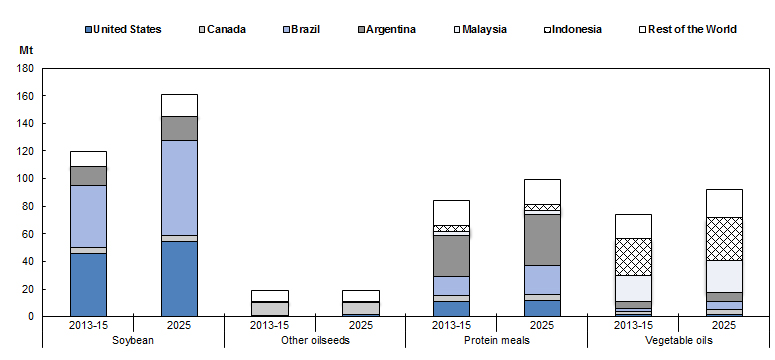

Whereas soybean, other oilseeds and protein meal exports are dominated by the Americas, vegetable oil exports continue to be dominated by Indonesia and Malaysia (Figure 3.2). Vegetable oil, at 42%, is one of the agricultural commodities with the highest share of production that is traded. It is expected that this share remains stable throughout the projection.

Figure 3.2. Exports of oilseeds and oilseed products by region

Source: OECD/FAO (2016), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-data-en.

In addition to the issues and uncertainties common to most commodities (e.g. macro-economic environment, crude oil prices and weather conditions), the oilseed complex has its specific supply and demand sensitivities. The expected expansion of soybean and palm oil production depends on the availability of additional new land which might be constrained by new legislation aimed at protecting the environment. The low soybean stock-to-use level projected for the end of the outlook period is a source of uncertainty for the stability of prices if the sector is affected by adverse weather events. Biofuel policies in the United States, the European Union and Indonesia are also a source of major uncertainties in the vegetable oil sector because they have an impact on a considerable share of the demand in these countries.

» Access the oilseeds chapter and all graphs on the OECD iLibrary