Cereals

Market situation

Global cereal markets have been characterised over the past few years by abundant supplies amid slower demand growth. As a result, world inventories have increased and international prices of all cereals have fallen to relatively low levels compared to the previous decade. Even the decline in world cereal production in 2015, following the 2014 record harvest, could not reverse this downward pressure, leading to further declines in international prices during the 2015 marketing year (see glossary for a definition of marketing year). Given the early prospects in world cereal output for this season, weak demand and large inventories in 2016, global markets are likely to experience relatively low prices. Against this background, only radical or sudden changes in demand or supply are likely to alter the short-term outlook.

Projection highlights

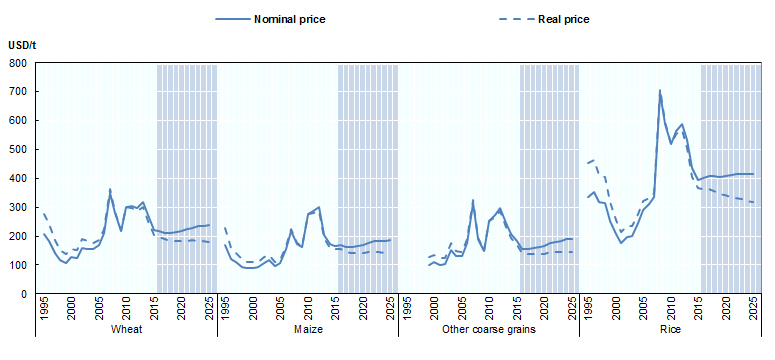

Starting with relatively low prices during the base period (2013-15), the prevailing sluggish economic growth conditions, large stocks, low oil prices and a strong US dollar are likely to keep prices under pressure in the short run. Over the course of the medium-term, however, prices of wheat and coarse grains (in nominal terms) are projected to be primarily cost driven, increasing in nominal terms but not by enough to keep pace with inflation, implying slight declines in real terms. However, prices of all cereals even in nominal terms are projected to be lower on average than in the previous decade, although well above the levels of the decade before.

Global cereal production is projected to expand by 12% by 2025 from the base period, mainly driven by yield improvements, with limited area expansion. Compared with the base period, production of wheat in 2025 is projected to increase by 10% (71 Mt), with India producing 10 Mt more, the People’s Republic of China (hereafter “China”) 7.9 Mt Argentina 5.6 Mt, Ukraine 5 Mt, the Islamic Republic of Iran 4.7 Mt, Turkey 4.2 Mt, the European Union 3.5 Mt, the Russian Federation 3.1 Mt, Canada 1.9 Mt and the United States 1.7 Mt. Rice production is set to increase by 14% (69 Mt), with most of the increase (59 Mt) concentrated in Asian countries, led by India (20 Mt), Indonesia (8.1 Mt), Viet Nam (6 Mt), Bangladesh and China (4 Mt each), as well as Thailand (2.8 Mt). Maize production is projected to rise by 13% (131 Mt), led by the United States (27 Mt), Brazil (21.5 Mt), China (21 Mt), Argentina (6 Mt), the European Union (5.6 Mt), and Indonesia (4 Mt). Production of other coarse grains is projected to increase by 8%, or 25 Mt, with the biggest increases in Ethiopia (5.5 Mt), Argentina (3.1 Mt) and India (2.9 Mt), followed closely by Nigeria (1.9 Mt).

Global cereal use is projected to grow by 14% or 340 Mt, to reach 2 818 Mt by 2025. Wheat consumption is expected to increase by 11% compared to the base period and continues to be largely used for human consumption (69% of total use throughout the projection period). The use of wheat for feed is projected to increase, mostly in China, the Russian Federation and the European Union, while biofuel use of wheat only accounts for 1.2% of global use in 2025. Maize use for animal feed is projected to increase its overall share over total use from 56% in the base period to 60% in 2025. The projected increase in total maize utilisation (157 Mt), is mainly driven by higher feed use (127 Mt) – mostly on account of fast expanding livestock sectors in developing countries. Maize for human consumption is projected to grow by 21% (28 Mt), mainly in developing countries, especially those in Africa where white maize is a main staple in several countries. The use of other coarse grains is also set to grow, by 11% (31 Mt), driven mainly by food demand (16 Mt) followed closely by feed demand (14 Mt). The expansion of food use mainly comes from Sub-Saharan Africa (13 Mt), while China accounts for most of the expansion for feed. Direct human consumption remains the main end-use of rice, as a major staple food in large parts of Asia, Africa, Latin America and the Caribbean. Total consumption is predicted to rise to 563 Mt by 2025, sustained principally by population growth. Given the expected demographic changes, Asian countries are anticipated to account for more than 80% of the projected increase in global rice consumption.

Figure 3.1. World cereal prices

Note: Wheat: U.S. wheat No.2 Hard Red Winter (fob), maize: U.S. GULF Maize, No.2 Yellow (fob), other coarse grains: Barley (feed Rouen), rice: Thailand, 100% B, 2nd grade.

Source: OECD/FAO (2016), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-data-en.

World trade in cereals by 2025 is projected to increase to 417 Mt, up 10% from the base period. At this projected level, global trade would be expanding at a slightly faster rate than production (1.6% p.a. vs. 1.2% p.a.), keeping the share of global production that is traded at 15%. For wheat, this share is expected to reach 22% by 2025, compared with 12% for maize and 15% for other coarse grains. Continuing historical trends, developed countries are expected to remain as the main exporters of wheat and coarse grains to developing countries, while rice is mostly traded between developing countries. The global players on international rice markets are expected to remain consistent, although exporters such as Cambodia and Myanmar are projected to increase their shares of the international market over the decade.

The anticipated continuation of lower cereal prices compared to the previous decade will impact on planting decisions and hence supply responses. Relative prices to other crops like oilseeds are therefore an important factor over the next decade which might lead to stronger reallocation of crops. On the demand side, developments in the fastest growing economies will have more profound implications for trade. Demand changes in China and their timing of releasing maize stocks are main uncertainties during the projection period.

» Access the cereals chapter and all graphs on the OECD iLibrary