Sugar

Market situation

International sugar prices fell by more than 30% in 2014. The prospect of a global sugar production deficit has led to a price increase at the start of the current season, but with stocks still at comfortable levels, the price increase is expected to average slightly above 2% in the 2015 marketing year (see glossary for a definition of marketing year).

Indeed, there has been a slowdown in output growth since 2013, and global sugar production is expected to fall by about 5 Mt in 2015. Given steady growth in global consumption, this should put an end to the surplus phase. Increases in sugar production are foreseen in Brazil (the leading producer and exporter), Australia, the Russian Federation and Thailand, but two main producers, India and the European Union, will see a decrease. After four years of replenishing global stocks, the stocks-to-use ratio should begin to decline at the start of the 2016-2025 outlook period.

Projection highlights

The continuation of in place domestic policy measures as well as Brazil’s sugarcane production prospects will continue to largely influence the sugar market over the medium-term. World sugar prices, when denominated in US dollars, are not expected to increase much as production prospects should be able to satisfy a growing world demand, notwithstanding WHO recommendations to reduce daily “free” sugar intake to less than 10% of total energy intake.

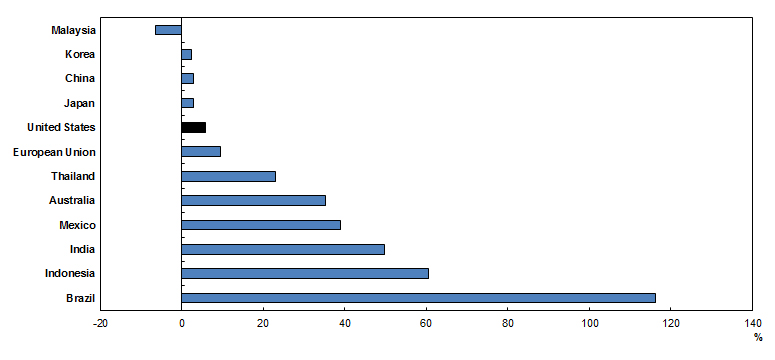

In terms of the macro-economic assumptions underpinning the Outlook, exchange rates are a key factor affecting the sugar market. Over the forecast period, the USD is assumed to strengthen against the majority of currencies, enhancing the competitiveness of major sugar exporters on the world market, especially Brazil. In contrast, a few deficit countries located mainly in Asia (China, Korea, Japan, Malaysia), will benefit from a firming of their exchange rates against the USD, making imports less expensive when denominated in local currencies.

Figure 3.3. Change in world nominal raw sugar prices when denominated in selected national currencies, 2025 vs. 2013-15

Source: OECD/FAO (2016), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-data-en

World sugar prices, with the return to a deficit phase, are expected to increase only slightly for a couple of years as a consequence of high level of stocks and low oil prices. They are then foreseen to follow a moderate upward trend. The international raw sugar price (Intercontinental Exchange No. 11 contract nearby futures) is projected to reach USD 342/t (USD 15.5 cts/lb) in 2025, in nominal terms. Similarly, the indicator world white sugar price (Euronet, Liffe futures Contract No.407, London) is projected to reach USD 425/t (USD 19.2 cts/lb) in nominal terms in 2025. The white sugar premium (difference between white and raw sugar prices) should temporarily decline in 2017 with the decline in the EU raw sugar imports after quota abolition, before returning to a level close to USD 83/t at the end of the period.

The sugar sub-sectors in many developed and developing countries will continue to benefit from domestic policy support measures such as high import tariffs, tariff rate quotas, and minimum price support. These policies will continue to distort markets and contribute to the relatively elevated level of market volatility. However, new policies will liberalise the sugar market to some extent, such as the abolition of sugar quotas in 2017 in the European Union and the deregulation of sales of sugar in the open market in India.

Brazil’s sugar sector has faced financial problems for several years, but will benefit from the weakness of the Brazilian real. Government policies continue to support ethanol production from sugarcane, but the share of sugarcane devoted to ethanol production should slightly decline over the outlook to 57%. This will displace sugar sales in domestic and export markets. Globally, a higher share of sugarcane production will be devoted to producing ethanol, rising from about 20.7% during the base period to 22.3% in 2025.

Global sugar production, despite an expected fall in the coming season in some producing countries, should rise over the course of the decade, sustained by demand growth and a reduction in stocks. Over the ten-year period, the growth in production is foreseen to average 2.1% per annum (p.a.), with production reaching 210 Mt by 2025, an increase of around 39 Mt over the base period (2013-15). Most of the additional production will originate in countries producing sugarcane rather than sugar beet, and the main driver of output growth is area expansion, notably in Brazil, even though yield improvements are foreseen for sugar crops and sugar processing in some other producing countries (India and Thailand).

The anticipated growth in world sugar demand for the next decade is steadier with an increase of 2% p.a. resulting in a decrease of the stock-to-use ratio from 45% in the base period to 39% in 2025. However, the growth in demand is mixed with nearly no growth in the matured developed countries and stronger prospects in developing countries, in particular Africa and Asia. In developing countries with high sugar calorie intake, no noticeable changes in consumer habits are foreseen, as sugar is an available, cheap source of energy, which is easy to transport and store.

In the face of growing global demand, sugar exports are likely to expand in countries that have modernised their sugar sub-sector in recent years (e.g. Australia, European Union, and Thailand). Brazil will remain the world’s major producer and exporter, but lose market share at the start of the period, opting for more profitable ethanol production in the short-term. Favourable currency terms should encourage investment. Overall, Brazil’s share of world sugar exports is expected to decline at the start of the projection period before recovering to a level close to that achieved during the base period (41%). On the other side, imports will remain diversified, mostly driven by demand from Africa and Asia.

Over the medium-term, the interaction between the sugar market and other sectors such as the feed sector, biofuels, and other caloric sweeteners (e.g. isoglucose) will generate feedback effects. Also, with existing policies and high fixed costs, the sugar sector should stay volatile. Furthermore, any external shock to one of the related markets, or to the exogenous assumptions, could alter the results discussed in this report.

» Access the sugar chapter and all graphs on the OECD iLibrary