Meat

Market situation

Weaker demand for meats by emerging economies and oil exporting countries throughout 2015 exerted significant downward pressure on meat prices. According to the FAO Meat Price Index, meat prices in 2015 fell to a level last seen in early 2010. This fall contrasts with an extended period of continued, though at times volatile, meat price increases that started back in 2002. Only once during this extended period – during the aftermath of the 2007-08 financial crisis – have meat prices fallen by such a magnitude.

World trade in 2015 stalled in volume terms. Meat exports from the Americas, the dominant supplier region, fell in 2015 reflecting weakening supply to the rest of the world. Lower imports from the Russian Federation, and a net trade loss in North America estimated at close to one million tonnes, substantially reduced supplies going to other parts of the world.

Projection highlights

The Outlook for the meat market remains strong. Feed grain prices are set to remain low for the projection period, giving stability to a sector that had been operating in an environment of particularly high and volatile feed costs over most of the past decade. This is particularly relevant for regions such as the Americas, Australia and Europe, where feed grains are being used more intensively in the production of meat.

Global meat production is projected to be 16% higher in 2025 than in the base period (2013-15). This compares with an increase of almost 20% in the previous decade. Developing countries are projected to account for the vast majority of the total increase, through a more intensive use of protein meal in feed rations. Poultry meat is the primary driver of the growth in total meat production in response to expanding global demand for this more affordable animal protein compared to red meats. Low production costs and lower product prices have contributed to making poultry the meat of choice both for producers and consumers in developing countries. In the bovine meat sector, several years of cow herd liquidation in major producing regions resulted in low beef production in 2015. However, production is expected to grow from 2016 onwards, with higher carcass weights more than offsetting the decline in cattle slaughter. Pigmeat production will also grow after 2016, driven by China, where herd size is expected to stabilise after years of substantial reductions (a drop of 25 million pigs between 2012 and 2015). Another factor contributing to China’s output expansion in the coming years is further consolidation of the pork sector. Production is also expected to increase in the sheepmeat sector with an expected global growth of 2.1% p.a., a higher rate than the last decade, and led by China, Pakistan, Sudan and Australia.

Globally 10% of meat output will be traded in 2025, up from 9% in 2015, with most of the increase coming from poultry meat. Import demand will be weak during the first years of the outlook period, mainly due to lower imports due to the import ban of the Russian Federation and slower growth in China, but will strengthen in the second half of the projection period, due to import growth in the developing world. The most significant growth in import demand originates from Viet Nam, which captures a large share of additional imports for all meat types. Africa is another fast growing meat importing region albeit from a lower base. Although developed countries are still expected to account for slightly more than half of global meat exports by 2025, their share is steadily decreasing relative to the base period. On the other hand, Brazil’s share of global exports is expected to increase to around 26%, contributing to nearly half of the expected increase in global meat exports over the projection period.

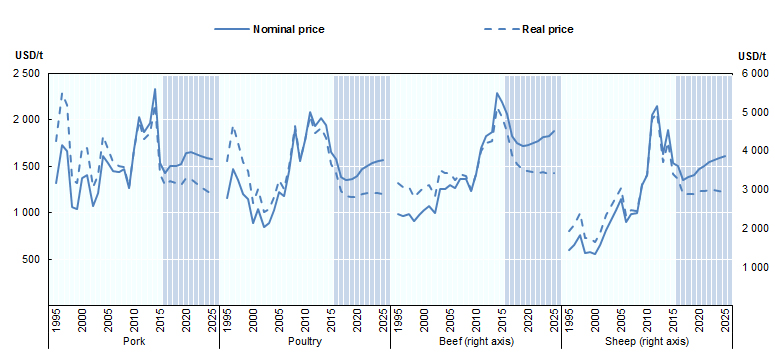

Nominal meat prices are expected to start at levels similar to those registered in 2010, and in most cases, trend marginally upwards. By 2025, prices for beef and pigmeat are projected to increase to around USD 4 497/t carcass weight equivalent (c.w.e.) and USD 1 580/t c.w.e. respectively, while world sheepmeat and poultry prices are expected to rise to around USD 3 857/t c.w.e. and USD 1 571/t product weight (p.w.) respectively. In real terms meat prices are expected to trend down from their recent high levels (Figure 3.4).

Figure 3.4. World meat prices

Note: US Choice steers, 1 100-1 300 lb dressed weight, Nebraska. New Zealand lamb schedule price dressed weight, all grade average. US Barrows and gilts, No. 1-3, 230-250 lb dressed weight, Iowa/South Minnesota. Brazil: Export unit value for chicken (f.o.b.) product weight.

Source: OECD/FAO (2016), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-data-en.

Global annual meat consumption per capita is expected to reach 35.3 kg retail weight equivalent (r.w.e.) by 2025, an increase of 1.3 kg r.w.e. compared to the base period. This additional consumption will consist mainly of poultry. In absolute terms, total consumption growth in developed countries over the projection period is expected to remain small relative to developing regions, where rapid population growth and urbanisation remains the core drivers. This is particularly true in Sub-Saharan Africa, where the rate of total consumption growth over the outlook period is faster than any other region. The composition of growth is also somewhat unique, with the absolute growth in beef almost matching poultry.

Globally, animal disease outbreaks and trade policies remain among the main factors driving the evolution and dynamics in world meat markets. The implementation of various trade agreements, such as the proposed Trans-Pacific Partnership, over the outlook period could increase and diversify meat trade. An announcement in 2015 by International Agency for Research on Cancer of the World Health Organization (IARC) classified processed meat as carcinogenic. This raised concerns among consumers worldwide and may impact the projected consumption of countries with high per capita meat consumption.

» Access the meat chapter and all graphs on the OECD iLibrary