Cotton

Market situation in 2017

The recovery in the world cotton market continued during the 2017 marketing year following the slight increase in production in 2016, with production reaching 25.6 Mt. Global cotton production recovered by about 11.1% in 2017 due to improved yields and recovered areas. In addition, on-going stock releases helped to stabilise world consumption, although total world stocks remain at a very high level (at 19.2 Mt, still about eight months of world consumption). Production increased in almost all major cotton producing countries, including the People’s Republic of China (hereafter “China”) which recovered by 7% in 2017. Pakistan, the United States, Turkey and India increased production by 24%, 24%, 18% and 9%, respectively due to increases in yields and in the area planted.

Global cotton demand increased slightly during the 2017 marketing year to 25.0 Mt. Mill consumption estimates show an increase of 3% (to 5.3 Mt) in India and in a stable 8.0 Mt in China. Mill consumption increased in Viet Nam by 12% and in Bangladesh by 6.9% as Chinese direct investment in mills continued. The increase in Pakistan was 4%. Global cotton trade recovered by 1.0% in 2017 to 8 Mt. Increases in imports by Bangladesh, Pakistan and Viet Nam were insufficient to offset the decline in many countries’ import demand from 2016. China’s cotton support policy has continually narrowed the price gap between domestic and imported cotton, and both cotton prices were moving almost in parallel in 2017. In addition, US exports remained stable at 3.1 Mt from 2016, and Australia’s exports continued to increase by 3% in 2017 due to a recovery in production from 2014.

Cotton consumption by region

Projection highlights (2018-2027)

Although the world cotton price is continuously under pressure due to high stock levels and strong competition from synthetic fibres, cotton prices are expected to be relatively stable in nominal terms during the outlook period. This makes cotton less competitive because prices for polyester are significantly lower than both international and domestic cotton prices. During 2018-27, relative stability is expected as government support policies continue to stabilise markets in major cotton-producing countries. However, world cotton prices are expected to be lower than the average in the base period (2015-17) in both real and nominal terms.

World production is expected to grow at a slower pace than consumption during the first few years of the outlook period, reflecting the anticipated lower price levels and projected releases of global stocks accumulated between 2010 and 2014. The stock-to-use ratio is expected to be 39% in 2027, which is well below the average of the 2000s of 46%. The global land use devoted to cotton is projected to remain slightly lower than the average in the base period. Global cotton yields will grow slowly as production gradually shifts from relatively high yielding countries, notably China, to relatively low-yielding ones in South Asia and West Africa.

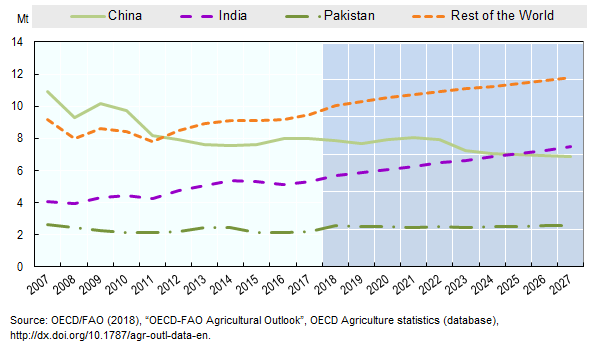

World cotton use is expected to grow at 0.9% p.a. as a result of slower economic and population growth in comparison with 2000s, reaching 28.7 Mt in 2027. Consumption in China is expected to fall by 12.5% from the base period to 6.9 Mt in 2027, continuing its downward trend, while India will become the world’s largest country for cotton mill consumption with an increase by 42.2% to 7.5 Mt in 2027. Higher cotton mill consumption by 2027 is also foreseen for Viet Nam, Indonesia, Bangladesh, and Turkey, with consumption increasing by 74%, 45%, 34% and 17% from the base period respectively.

It is expected that global cotton trade will grow more slowly compared to previous years. Trade in 2027 is expected, however, to exceed the average of the 2000s. To obtain value-added in the textile industry, there has been a shift in the past several years towards trading cotton yarn and man-made fibres rather than raw cotton, and this is expected to continue. Global raw cotton trade will nevertheless reach 9.4 Mt by 2027, 19% higher than the average of the base period 2015-17. In 2027 the United States remains the world’s largest exporter, accounting for 36% of global exports, 1% point higher in the base period. Brazil’s exports are projected to reach 1.2 Mt in 2027, 0.5 Mt more than in the base period. This makes Brazil the second largest exporter overtaking India. The third largest exporter will be Australia with exports increasing from 0.7 Mt in the base period to 1.0 Mt. Cotton producing countries in Sub-Saharan Africa will increase their exports to 1.6 Mt by 2027. On the import side, China’s imports are expected to slightly grow to 1.2 Mt in 2027 which is still a low level in comparison to those reached during the last decade. Suppressed low domestic consumption and releases of stocks, as well as reduced producer support are behind this development. China’s dominant role in the world cotton market will be significantly challenged as other importing countries emerge. It is projected that imports in Viet Nam and Bangladesh will increase respectively by 0.8 Mt and 0.5 Mt, and Indonesia and Turkey will import 1.0 Mt and 0.8 Mt by 2027 respectively.

While continuing increases in farm labour costs and competition for land and other natural resources from alternative crops place significant constraints on growth, higher productivity driven by technological progress and the adoption of better cotton practices, including the use of certified seeds, high density planting systems and short duration varieties. Altogether, this creates significant potential for cotton production to expand in the next decade. While the medium-term prospects are for sustained growth, there may be potential short-term uncertainties in the current outlook period which may result in short-term volatility in demand, supply and prices. A sudden slow-down in the global economy, a sharp drop in trade of global textiles and clothing, competitive prices and quality from synthetic fibres, and changes in government policies are important factors that can affect the cotton market.

» The full chapter is available here.

Related Documents