Meat

Market situation in 2017

Overall world meat production increased by 1.25% to 323 Mt in 2017, with moderate increases in the production of bovine and poultry meats and more modest gains in pig and sheep meat. Much of the world meat production expansion originated in the United States but other main contributors were Argentina, India, Mexico, the Russian Federation and Turkey. Meat production in the People’s Republic of China (hereafter “China”), the world’s largest meat producer, increased little overall mainly because of the lower growth in poultry meat production as several Avian Influenza (AI) outbreaks affected the country. Nevertheless, China remained the second largest contributor to the 2017 increase in meat production.

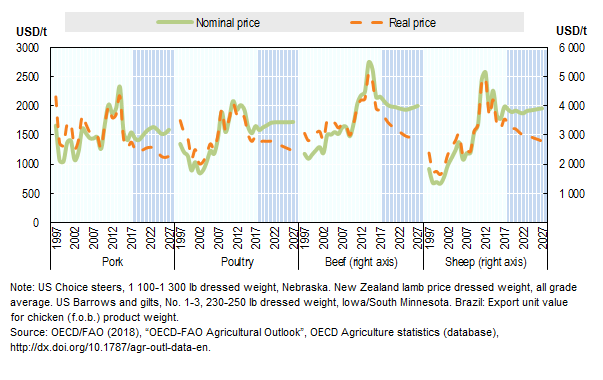

Measured by the FAO Meat Price Index, the monthly average for the whole of 2017 was 9% higher than in 2016, but 2.3% below the average of the preceding three years.. International meat prices rose in the first half of 2017, underpinned by a significant increase in import demand for bovine and pigmeat categories. Short availability of export supplies of sheepmeat provided some additional support. As of July, prices began to level off and declined moderately as export supplies increased and import demand weakened. Across the four main meat categories, from January to December 2017, ovine meat prices rose by 35%, and bovine, poultry and pigmeat increased, respectively, by 7.7%, 3.2% and 2.9%.

World meat trade increased to 31 Mt in 2017, 1.5% higher than in 2016, but growth was slower than the 5% registered in 2016. Across categories, world trade expanded in bovine meat by 4.7% and poultry by 1%, while those shipments of pigmeat declined by 0.7% and sheepmeat by 3%. Somewhat sluggish growth in trade in 2017 compared to 2016 reflects a slowdown in imports by China, the European Union, Egypt, Saudi Arabia, Turkey, and the United States, in some cases caused by larger domestic supplies and in others due to falling demand. Meat imports, however, increased in several countries, notably Angola, Chile, Cuba, Japan, Mexico, Korea, Indonesia, Iraq, the United Arab Emirates, Ukraine, and Viet Nam. The expansion of world meat trade exports in 2017 was largely led by Argentina, Canada, India, Thailand, the United States, and Ukraine whereas sales by the European Union and New Zealand declined.

World meat prices

Projection highlights (2018-2027)

This year’s Outlook projects an expansion in meat supply which should result in short-term meat prices declining relative to 2017. The herd rebuilding cycle observed in several regions is nearing an end and additional supply is expected to enter the market in the early years of the projection period. Feed grain prices are also projected to remain low during this period, benefitting regions – such as the Americas, Australia and Europe – where feed grains are more intensively used in meat production. Over the medium term prices will strengthen as per capita meat consumption expands in key developing countries, in particular Latin America and Asia. The projection indicates that per capita consumption growth, when compared to the base period (average 2015 to 2017), will increase by 2.8 kg retail weight equivalent (r.w.e.) in developed countries and by half this amount in developing countries. Incomes in least developed countries (LDC) are projected to increase somewhat, leading to a small increase in per capita meat consumption in LDC countries. At the global level, per capita meat consumption will increase slightly more than 1 kg r.w.e.

Global meat production is projected to be 15% higher in 2027 relative to the base period. Developing countries are projected to account for the vast majority of the total increase, with greater use of a grain-intensive feeding system in the production process, resulting in increased carcass weight. Poultry meat remains the primary driver of the growth in total meat production, but in the coming decade this growth will slow significantly compared to that of the previous one. Growth in global demand for animal protein in the next decade is projected to slow down for poultry and pigmeat, but increase for beef and sheep meat. Lower product prices have contributed to making poultry and pigmeat the meat of choice, particularly for consumers in developing countries. With income growing over the projection period, those consumers are expected to increase and diversify their consumption towards more expensive meat protein such as beef and sheep.

In the bovine meat sector, cow herds have been rebuilt faster than expected in North America, which will lead to rising slaughter numbers and ample supply of meat on the world market for the coming years. Production will further increase as countries in the herd rebuilding phase, such as Australia, and Brazil are further along the cycle, providing additional supplies of meat in the early years of the projection period. Pigmeat production will also increase, driven by steady herd expansion in China which was slowed by more stringent environmental regulations and animal welfare concerns affecting the pork sector.

The year 2017 was affected by numerous outbreaks of Avian Influenza (AI) around the world which resulted in a slower increase in world output. China, the second largest producer after the United States, was particularly affected by several outbreaks over the last years and this Outlook assumes a return to historical trend growth in China poultry production from 2018 onwards. Production is also expected to increase in the sheepmeat sector with an expected global growth of 1.8% p.a., a higher rate than in the last decade. Production increases will be led by China, but increases will also occur in India, Nigeria, Oceania, Pakistan, Turkey, and Yemen.

Globally, the share of meat output traded is expected to remain constant over the projection period, at around 10%, with most of the increase in volume coming from poultry meat. The projected production growth in developing countries remains insufficient to satisfy demand growth, particularly in Asia and Africa. Consequently, import demand is expected to remain strong throughout the outlook period. The most significant growth in the share of additional meat import originates from the Philippines and Viet Nam. Developed countries are still expected to account for more than half of global meat exports by 2027, but their share decreases slightly relative to the base period. The combined share of the two largest meat exporting countries, Brazil and the United States, is expected to increase to around 47%, contributing nearly two-thirds of the expected increase in global meat exports over the projection period.

At the start of the outlook period, nominal meat prices are projected to be marginally lower as the supply expands and exerts downward pressure on prices. Meat nominal prices are projected to gradually increase until 2027 relative to the earlier years of the projections. By 2027, the price for beef is projected to increase to USD 4 000/t carcass weight equivalent (c.w.e.) and to increase to USD 3 900/t c.w.e. for sheepmeat, while world pigmeat and poultry prices are expected to rise to around USD 1 600/t c.w.e. and USD 1 700/t product weight (p.w.) respectively. In real terms, prices are expected to trend downwards for all meat types, although meat-to-feed price margins will generally remain within historical levels.

Global meat consumption per capita is expected to increase to 35.4 kg r.w.e. by 2027, an increase of 1.1 kg r.w.e. compared to the base period. Despite high population growth rates in much of the developing world, total consumption is also expected to increase by 1.4 kg r.w.e., half of the increase expected in developed countries. Additional per capita consumption at the global level will consist mainly of poultry with 0.8 kg r.w.e., while beef, sheepmeat and pigmeat will change marginally. In per capita terms the growth will be fastest in Latin America, with an increase of 3.7 kg r.w.e. In absolute terms, total consumption growth quantities in developed countries over the projection period is expected to be approximately a fourth of that in developing regions, where rapid population growth and urbanisation remain the core drivers. These drivers are particularly important in Africa, where the rate of total consumption growth over the outlook period is faster than any other region. Import demand is also expected to grow the fastest in Africa.

Globally, animal disease outbreaks (e.g. swine fever), sanitary restrictions, and trade policies remain the main factors driving the evolution and dynamics in world meat markets. The projections reflect the implementation of various trade agreements, domestic policies and sanitary and phytosanitary restrictions announced or in place by 1 January 2018. Uncertainties related to existing or future trade agreements over the outlook period could impact and diversify meat trade patterns. Domestic policies development could also impact the meat sector such as the review in 2018 of the US Farm Bill. Further factors that could impact the meat outlook include consumer preferences and attitudes towards meat consumption. Consumers are showing a preference for free-range meat and antibiotic-free meat products, but the extent to which they are willing and able to pay a premium for them remains unclear.

» The full chapter is available here.

Related Documents