Sugar

Market situation in 2017

After two consecutive seasons of supply shortage, global sugar production rebounded in the 2017 marketing year (October 2017-September 2018), with growth close to that recorded five years ago. Good weather conditions in India and Thailand, increased production in the People’s Republic of China (hereafter “China”) and the end of production quotas in the European Union are the main reasons for this increase. But the largest producer, Brazil, experienced a decline in sugar output as processing sugarcane into ethanol became more profitable than sugar production.

Global sugar imports dropped by 10% in 2016 and despite the lower prices in 2017, imports continued to decline, mainly due to lower imports in China. On the demand side, there is no growth in per capita consumption in high consuming countries, where consumers' attitude towards sugar has changed because of health concerns associated with high consumption levels. Prices increased during the first months of the 2016 marketing year, but started to decline during the first quarter of 2017. As a result, annual average prices during the 2017 marketing year are expected to be lower than in 2016, but still slightly above the average of the last 25 years.

Global caloric sweetener consumption

Projection highlights (2018-2027)

Starting at relatively low levels, the price of raw sugar in USD is projected to increase in nominal and real terms during the next marketing year (2018). Over the remainder of the medium term, it is projected to follow a moderate upward trend in nominal terms, in line with the inflation rate of 2.3% p.a., but a downtrend in real terms. The white sugar price is foreseen to follow a similar pattern. A relatively tight white sugar premium (the difference between white and raw sugar prices) at the start of the projections (USD 62/t) is expected to widen slightly for a couple of years to USD 81/t, but will stay relatively low compared to the average over the last decade (USD 93/t).

Both sugarcane and sugar beet are foreseen to continue to expand in producing countries, driven by remunerative returns in comparison to alternative crops. Sugarcane will remain the main crop to produce sugar (about 86%) and is cultivated largely in tropical and sub-tropical countries in Africa, Asia and Latin America and the Caribbean. The remainder will come from sugar beet, which is grown in more temperate zones, mainly Europe. The share of sugar from sugar beet relative to sugarcane is expected to remain relatively constant on the outlook period, at around 14%.

Over the next ten years, 83% of the increase in sugar output is projected to originate in developing countries. In absolute terms, major changes in global production are expected in India (+20%), followed by China (+11%), Brazil (+11%), Thailand (+9%) and the European Union (+5%). Brazil is projected to remain the main producer, providing more than a fifth of the world's sugar production, although its sugar sector could face increased competition from the use of sugarcane for ethanol. A slower growth of production compared to the previous decade is foreseen in Asia (India, Pakistan and Thailand) and Europe, which explains the slower annual growth in global sugar production over the outlook period (+1.5%) compared to the previous decade (+2.0%).

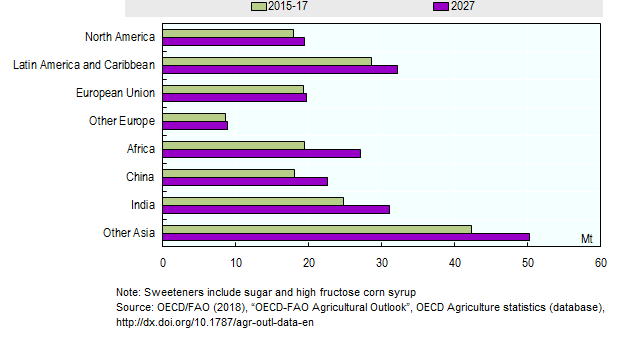

Demand for caloric sweeteners – sugar and high fructose corn syrup (HFCS) – is projected to grow by 33 Mt over the outlook period to reach 213 Mt in 2027 (see Figure above). The annual growth rate of 1.5% over the projection period is slightly lower than the one experienced during the last decade (1.6% p.a.). This lower growth rate is the result of the slowdown in global population growth and stagnant per capita consumption growth in developed countries and certain developing countries (Brazil, Egypt, Mexico, Paraguay, South Africa, Turkey), where per capita consumption has reached levels that raise health concerns (obesity, diabetes and other associated health issues). In countries with lower consumption levels, particularly in Asia and Africa, population growth and urbanisation are expected to sustain growth in sugar consumption, driven by increased consumption of sweetened beverages and prepared food products, particularly in Asia and Africa.

The distribution of global trade is expected to remain fairly constant over the projection period, with Brazil keeping its role as the main sugar exporter (45% of global trade). White sugar exports will represent nearly 34% of global trade over the outlook period, an increase from the 31% observed during the base period. Exports of white sugar are expected to increase in the European Union in the short term following the end of production quotas, and in countries that have built refineries (Middle Eastern countries and Algeria). Imports will remain diversified, mostly driven by demand from Africa and Asia.

The outlook for sugar markets depends on several factors on the supply side. These include climatic conditions, prices of other competing crops or products, the evolution of input prices and exchange rates, domestic policies and also import tariffs (which have increased in China). The demand side is more stable with stronger prospects in countries where consumption is still relatively low, but weak projections in countries where high levels of per capita consumption have been reached. Many developed countries and some developing countries, including Mexico, Chile, Thailand and Saudi Arabia, have introduced a sugar tax on soft drinks in an attempt to reduce over-consumption of sugar. These taxes have prompted the food industry and manufacturers to adapt through product reformulation or the use of alternative sweeteners. The projections do not take into account unsigned policies.

» The full chapter is available here.

Related Documents